The force multiplier for Carriers and MGAs

The industry’s only CURE™

The industry’s first Centralized Underwriting Risk Environment.

ClearCURE™

Bring order to submission intake with cleared, appetite-ready files that flow straight into your core systems.

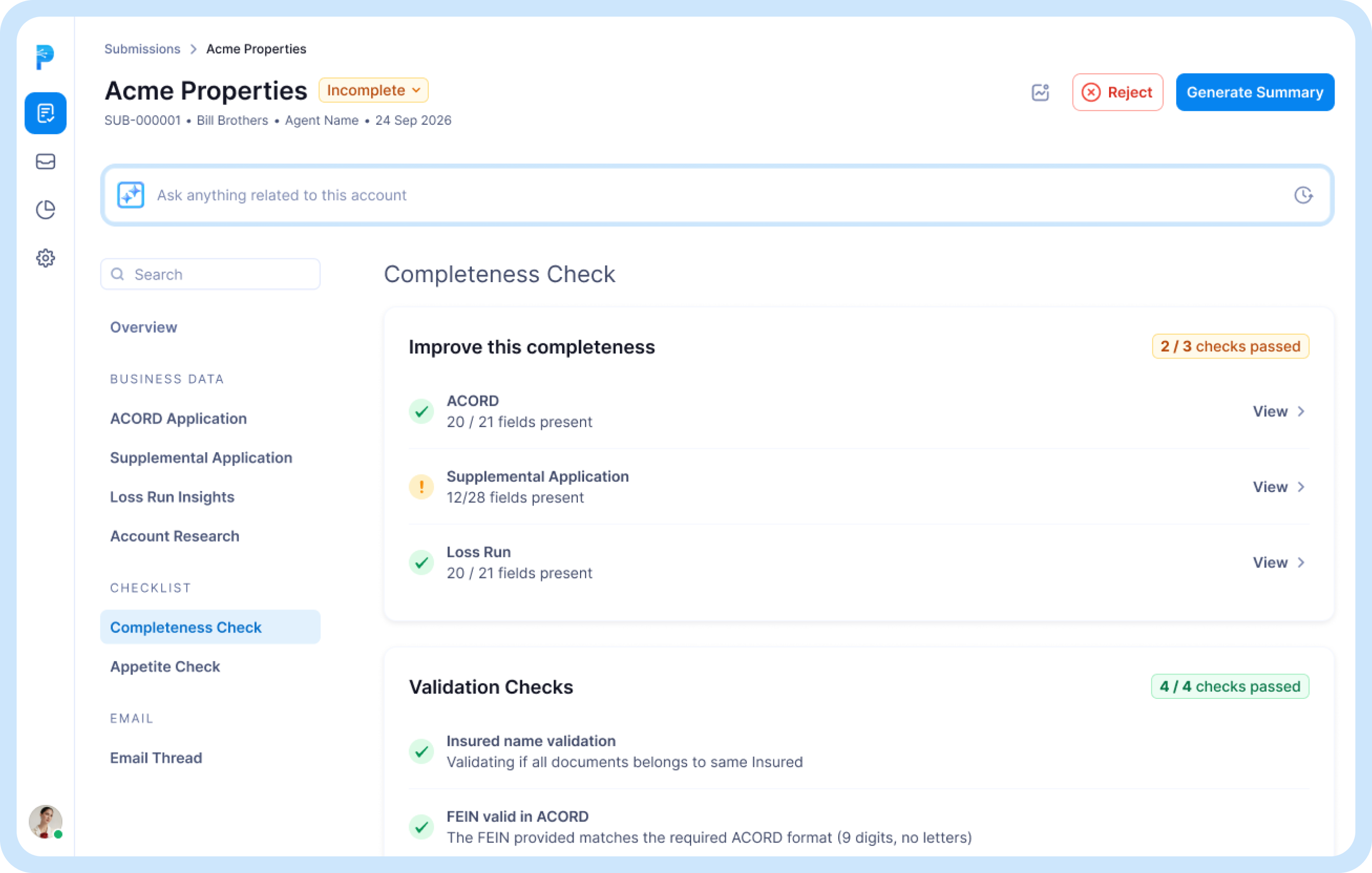

Completeness and appetite built-in

Define what a complete, in-appetite submission means for each line or program, then apply those checks automatically on every file so underwriters only see qualified work.

Actionable intake decisions

Automatically create and update submission records in PAS, workbenches, and raters with de-duplicated data, aligned to your internal schemas and ready for downstream processing.

Built on trust

Proven by results

Proof of impact

Client success stories

How CURE™ supercharged workers' comp underwriting with speed and accuracy.

25%

Underwriter’s time saved

Backed by

Member Of